A top-up loan or a concurrent personal loan - which option is best?

Even the best of financial planners can’t always predict life events that impact their finances. If you already have a personal loan and find yourself in a situation where you need access to some additional funds, there are two common options to consider: taking out a top-up loan with your current loan provider or taking out another personal loan to be repaid concurrently.

Let’s look at the differences between the two.

Option 1: Top-up loan

A top-up loan is a form of additional borrowing from a lender you already have a loan with. A top-up loan will use part of the money to settle the existing debt with your lender; the rest is given to you as cash. This ensures you only have one agreement active at any time, and one single monthly repayment. It makes managing finances a little bit easier.

For example, if your current loan balance is £2,000 and you want to borrow an additional £1,000, a top-up loan will involve opening a new loan for £3,000. £2,000 will be used to pay off your first loan, leaving you with the remaining amount. The top-up loan will increase your overall loan term and your monthly repayments.

As the lender is already familiar with you, the application process generally tends to be quicker than taking out a loan with a new lender. Another advantage of a top-up loan is that as you’ve improved your credit score by paying off your current loan in a timely manner, you might benefit from a lower interest rate when taking out a top-up. In fact, at Bamboo, we ensure customers never have to pay an interest rate higher than what they already pay on their current loan.

While agreeing to a top-up loan with a lender you already know may seem like a faster, more convenient option, you might find more suitable options elsewhere. Before signing any agreement, always take the time to shop around for alternatives.

Find out more on how Bamboo top-up loans work here.

Option 2: Concurrent loan

While you may be more familiar with top-up loans, there are some circumstances where a concurrent loan could make more sense.

A concurrent loan involves taking out a second personal loan alongside your current loan. This means having two separate repayments each month.

Some lenders offer concurrent loans to their customers, while others (including Bamboo) do not. This means that if you are one of our customers and want a concurrent loan instead of a top-up, you would need to apply for a new personal loan with a different lender.

With the new application you’ll go through the usual credit checks of the lender and the rate of interest you qualify for will depend on your credit profile along with a range of other factors. It’s always good to try a few comparison websites to see what options are available to you. You might qualify for a lower interest rate than what you currently pay, or it could possibly go higher.

It is interesting to note that if it does remain the same, the cost of taking a second loan could actually end up being a cheaper option.

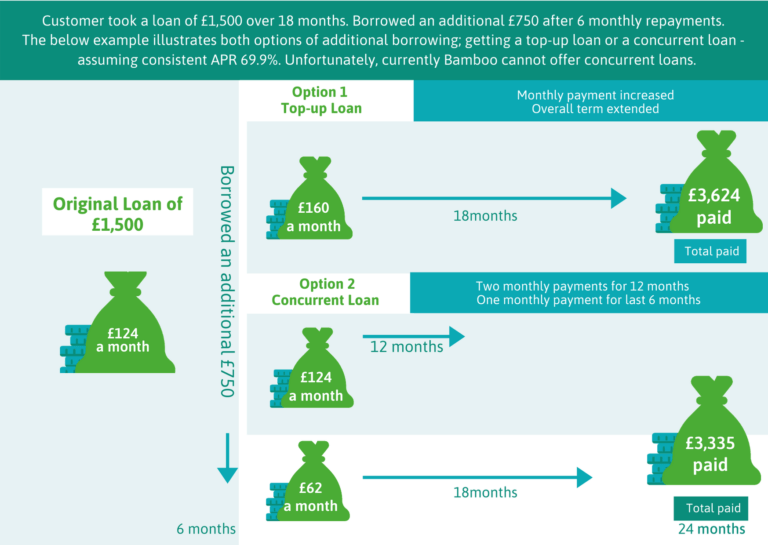

Here’s a breakdown of what you could be paying if you take out a concurrent loan rather than a top-up loan, provided the interest rate stays the same.

As you can see here in the example above, taking out a top-up loan would mean increasing your monthly repayments from £124 a month to £160 a month while also extending your loan term by another 6 months.

Comparatively with a concurrent loan you would have two monthly repayments to pay for 12 months. Once your first loan is paid off, you’ll be left with one monthly repayment of £62 for the last 6 months.

Overall, the total you would have paid back for a top-up loan would be £3,624 compared to £3,335 if you were to take out a concurrent (second) loan.

It’s important to note that the above example compares a scenario where you manage to get a concurrent loan at the same interest rate as your current loan. In reality it could be higher or lower than what you are currently paying.

Downside of additional borrowing

The risk of falling into a debt cycle is something to be especially careful of, regardless of whether you are looking for a top-up, a concurrent loan or some other forms of borrowing (e.g., a credit card). If you find yourself frequently in need of additional funding, it may be time to examine your finances and decide on some fundamental changes to help improve your financial situation.

You should also keep in mind that your credit profile will show that you have been borrowing additional funds, and this can raise red flags that your finances aren’t in good shape. Especially if you are planning to apply for credit for some big-ticket purchase – your house for example, showing that you are disciplined with money will help you get a mortgage more easily.

Finally, always remember that any late payments or defaults on your credit agreements will damage your credit score and could lead to worse outcomes, such as bankruptcy and repossessions. Whether you are applying for a top-up or a concurrent loan, always ensure that you can comfortably make the repayments.

Bottom line

There is no one-size-fits-all solution. It’s important to carefully consider all your options before deciding on whether to take out a top-up loan or a concurrent loan.

You should never take on more debt than absolutely necessary and always consider all the drawbacks before you do.

Author

The Bamboo Team

Posted

23 February 2021