Fraud Prevention

Scammers are becoming increasingly sophisticated in their ways of conning people. The best way to protect yourself from these fraudsters is by being aware of the different kinds of scams out there and knowing how to spot them.

How to spot and avoid online scams

Scammers are becoming increasingly sophisticated in their ways of conning people. The best way to protect yourself from these fraudsters is by being aware of the different kinds of scams out there and knowing how to spot them.

Types of scams and how they work

Fraudsters impersonating Bamboo

1. Scam phone calls

We have been made aware of several fraud attempts where consumers are being contacted over the phone and are offered a loan for an upfront fee. Please be aware, Bamboo does NOT charge any upfront fee. If you receive a phone call that you are unsure about, hang up and call us back on 0330 159 6010 and we will be able to confirm if it was a member of our team or not.

2. Scam texts

In the past, we have also been alerted to scammers sending out text messages purporting to be Bamboo. Here’s what they look like:

The advice from the National Cyber Security Centre is to forward any suspicious text messages to the number 7726. This free-of-charge text message service enables your telephone provider to investigate the origin of the text and take action, if found to be malicious.

Bamboo are also partnered with a company called CIFAS who offer a facility called “protective registration”. This facility is beneficial for individuals who would like an element of protection against identity theft.

3. Scam emails

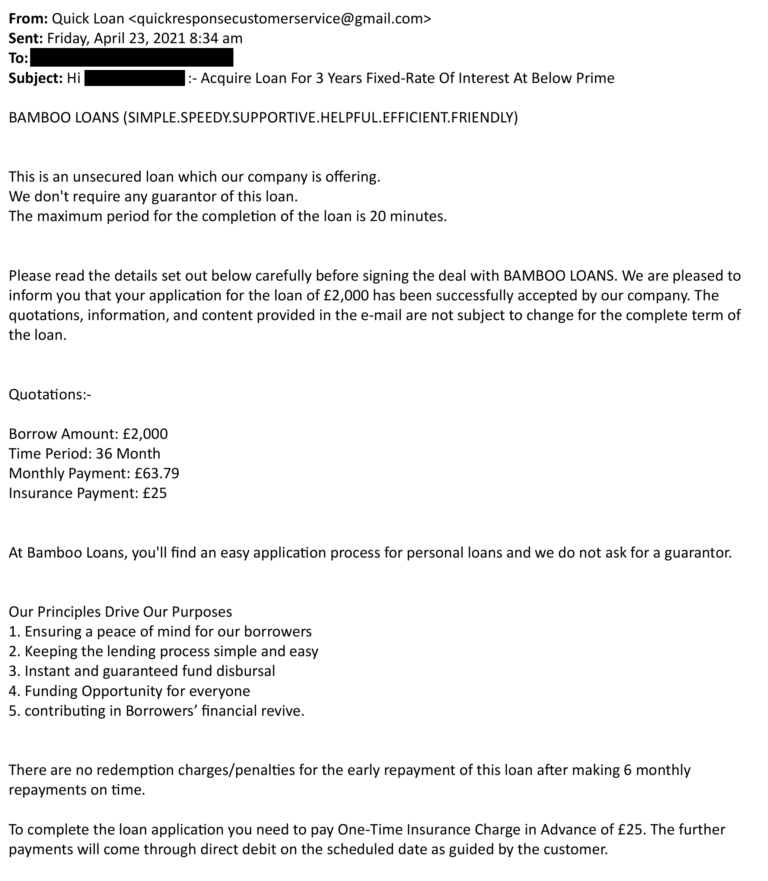

We have also seen some fraudsters impersonating Bamboo, offering fake loans via email.

The easiest way to spot them is by looking at the sender’s email address. They are often sent from a Gmail account with names like Quick Loan, quickmoneyinstanow, superquickservicenow. A genuine Bamboo email will only be sent from an email address ending in @bambooloans.com.

Also be wary of any emails asking you to make a payment to get a loan. Bamboo does NOT charge any upfront fee for your loan application.

Always double-check the sender details before sharing any personal details over email. Here’s an example of a scam email we have recently been alerted to:

Cryptocurrency

We are aware of scammers taking advantage of a growing interest in investing in online currencies, also known as cryptocurrency. Customers have been clicking on social media advertisements which offer financial services such as assistance with investments in cryptocurrency or stock trading. Scammers will pose as “financial advisors” from legitimate trading platforms and will present false profits that customers have supposedly made from small initial investments. Customers are then encouraged to take our personal loans after being advised that the more they invest, the more profit they will make and will be able to easily pay off any loans taken out. Once a significant amount has been invested, the scammer will cease contact and disappear with the money.

Bamboo is not affiliated with, nor will we provide the funding for, any cryptocurrency or stock trading platforms.

Vishing

Vishing (“voice” and “phishing”) is a scam that involves someone making contact with you via text, email or over the phone, saying they are calling from your bank, the HMRC or even the police. You may feel reassured that they are asking you certain questions to verify your identity, but providing this information can result in impersonation or identity theft. For example, someone might call you, purporting to be your bank, and ask you to confirm the answer to a security question you may have set previously. Scammers can then use that answer to pass security when they contact your bank on your behalf.

If ever in doubt, cease contact until you have double-checked with your bank or verified the legitimacy of the call. Be aware, scammers can often mask the number they are calling from to look like an official number, so consider verifying over a phone call rather than finding the number on a website. Take care when providing personal information.

Social Media

We are increasingly concerned to hear of scammers approaching customers through social media platforms offering investment opportunities, ‘get rich quick’ schemes, often involving cryptocurrency as mentioned above under the Cryptocurrency section. Customers are encouraged to apply for a loan as part of the ‘scheme’ with a promise to receive a profit. It is important to know that Bamboo have no links to any investment or cryptocurrency companies. If you take out a loan with Bamboo, you will solely be responsible to repay the loan.

On other occasions customers are approached on social media to ‘help improve their credit score’, this again is a scam. Nobody should ever take out a loan agreement to specifically just help their credit score. In both these scenarios, the scammers sometimes encourage the customer to open an account through a price comparison website and allow them access or persuade the customer to provide their login details for an existing comparison website. These details should never be given to any individual.

Mystery Shopping

Mystery shopping can be a fun way to earn a bit of extra money. The idea is that you get to dine in restaurants or shop around for different brands in exchange for your genuine feedback. You get paid back for what you spent on the brand.

However, this also makes for the perfect set up for scammers. Mystery shopping scammers mostly set up jobs that revolve around financial institutions. They might be asking you to review a money transfer service or something similar, by asking you to send money or deposit a cheque. Always be wary of anything involving financial transactions. A job that asks you to spend money upfront is most likely a scam.

Other mystery shopping scammers adopt alternatives like asking you to take out several expensive phones on a contract, a big loan, or something similar. They will then ask to meet up to take the items or money off of you promising you’ll get paid for the job. However, you’ll never receive anything other than a huge debt on your shoulders.

Competition Scams

With competition scams, you’re likely to receive an email or a message over social media saying you’ve won a big prize or a lot of money in a lottery, sweepstake, or something similar. The prize could be a laptop, smartphone, a big sum of money or even a lavish tropical holiday. But to claim the prize they’ll ask you to pay a fee. They’ll make this fee sound reasonable by putting it forward as courier charges, bank fee, government taxes, or some other sort of insurance costs.

These scams most often have a close deadline to create a sense of urgency, ‘Act now or lose out’ kind of statements are what you’ll often see on these ads. They try to get their victims in a surge of excitement hoping they’ll quickly follow through on the instructions without giving it much thought. Others might even ask you to keep your prize confidential until you receive it, in an attempt to keep you from disclosing it to others who might reveal the scam. Some of these scammers quite often mimic names of legitimate overseas lotteries so in case you do Google them, you’ll come across an authentic website that will make them seem real.

The best way to avoid these scams is to firstly always be wary of anyone asking for your personal details or money upfront. Secondly, if you don’t recall entering a competition, don’t fall for the false advertisement no matter how attractive it may seem. Finally, if the prize sounds too good to be true, it most likely is.

Romance and Dating Scams

These types of scammers are found lurking on dating apps and places like Facebook messenger or Whatsapp. They go around portraying themselves as someone looking for a serious relationship. They take their time building a bond with their victims, some even taking a good few months. They’ll share their personal details, things about themselves that will make them sound genuine. They go to great lengths showering their victims with words of love and buying them gifts.

Once they’ve gained their victim’s confidence and feel a strong bond has been established, they’ll conjure up an emotional story saying they require financial assistance for medical care or some other serious reasons. They’ll play on their victim’s emotions to get them to fall for it. They might, indirectly or directly, ask for their victim’s credit card or bank details for anything ranging from money laundering, identity theft, money scams, etc.

Always be super careful when speaking to anyone online. Never trust anyone you haven’t met in person and always be wary if they start asking for financial help.

Money Mules

These scammers often pose as employers offering genuine jobs to people desperate to earn some extra money. They reach out to their victims through job ads or even in-person offering ‘quick cash’ if they do a job for them. The job they are paying for will most likely involve the victim accepting money into their bank account and passing it on to another. This essentially is money laundering and carries a 14-year sentence in prison. The funds they ask their victims to help transfer may come from any kind of terrorist background or illicit activity. Getting caught in a scam like this can result in your bank account being closed down with years of trouble whenever applying for credit.

Don’t fall for any job that promises quick cash. If the pay sounds too good to be true, it most likely is!

Inheritance

These scammers can be found both online and face-to-face. They pose as bankers, lawyers or other foreign officials. They’ll contact you out of the blue, over email, text message, phone call or even through a social networking app. They’ll claim that a distant relative of yours or a wealthy benefactor has left a large inheritance that you can claim. Some claim that the deceased has no other beneficiaries and as you share the same last name as theirs, you can claim their inheritance through some legal loopholes.

Once you’ve fallen for their tricks and lies they’ll ask you to provide your personal details and pay some money for them to be able to process the documents. They go to extreme lengths putting together seemingly legitimate documents to prove the inheritance. They might even have a scamming partner call you, posing as a legal professional, helping to facilitate the transaction. Be very wary of sharing your personal documents especially birth certificates, as this can leave you open to identity theft too.

Authorised Push Payment

These scams are conducted online over emails, social networking sites, and even text messages. They often get in touch saying you need to confirm or verify your account by clicking on a certain link. They’ll use tricks like saying you are eligible for a tax rebate, or your Deliveroo, Amazon, or Uber account needs verifying. But the minute you click on their link and login with your details, they’ll hack your account and misuse it.

A lot of other Authorised Push Payment scams occur once the scammer already has some information on you. This could be the name of the nursery your child goes to, the phone network you use, or any other service that you occasionally receive bills from. They mimic the invoice of the company that you make regular payments to. So in a glance, their email will seem legitimate to you. The only difference will be that the bank details provided for the payment will be that of the fraudster and you, without realising, will end up sending money to the wrong bank account.

The best way you can keep yourself safe from such scams is to never make a payment you were not expecting. Even if you have the slightest bit of doubt, call the company to see if they are expecting a payment from you. So the next time you receive an invoice out of the blue, just take a few minutes to double-check before making a payment. Once the money leaves your account, it’s very hard to get it back.

Have you been scammed?

If you are cautious a recent transaction might have been a scam, contact the relevant agencies immediately. You can report any scams to Action Fraud. If you feel you might have been a victim to a loan scam from someone posing to be you on one of our applications or might have received an email that doesn’t seem right, please get in touch with us immediately.

However, if you feel a scam is putting you or someone else in danger, you should immediately call the police on 999.

Reporting scam emails and online fraud

If you receive an email that you believe is a scam, you can also report it to your email service provider like Gmail or Outlook. Most providers have a ‘report phishing’ or ‘report scam’ button that you can use to report an email address. For any online ads that you might see, you can report these to Google or Bing.